According to a post by Bright Simons, a writer and activist, the popular fintech company Zeepay is currently in a legal battle with a major bank.

The dispute, which Mr. Simons says has been filed in court, revolves around Zeepay’s inability to manage a staggering GHC 150 million in unsettled liabilities.

The case highlights the country’s digital payment infrastructure and reveals tensions in the ecosystem.

Mr. Simons notes that this case not only underscores issues surrounding Ghana’s payment ecosystem but also raises questions about regulation.

The Fintech Boom and Its Hidden Frictions

Zeepay currently operates in over 23 markets and has raised $24 million in venture capital and $18 million in debt.

The fintech allows users to make instant payments and enables the diaspora to send money directly to local bank accounts or digital wallets.

According to Bank of Ghana data, mobile money transactions in Ghana reached GHC 365 billion ($22.8 billion) in April 2025.

What helps power Zeepay and many other fintechs in the country is the Ghana Interbank Payment and Settlement Systems (GhIPSS), a government-owned platform that connects banks, fintechs, and other financial entities.

GhIPSS was established in 2007 by the Bank of Ghana and helps facilitate several services, including mobile money transfers and corporate payments.

For fintechs like Zeepay, accessing GhIPSS requires a banking partner to ensure liquidity and compliance with regulations, such as anti-money laundering and counter-terrorism financing measures.

This partnership is meant to provide a trusted backstop, ensuring that funds move smoothly across borders and institutions.

But when these relationships falter, as they have in Zeepay’s case, there can be severe consequences.

A Breakdown in Trust

According to the post by Mr Simons, Zeepay’s banking partner, a tier-one institution, accused the fintech of failing to clear 150 million Ghana Cedis in liabilities accrued through its remittance operations.

The process, while seemingly instantaneous to users, involves a delicate dance of delayed settlements.

When a sender in London transfers money to a recipient in Accra, the funds pass through a chain of intermediaries—banks, overseas accounts, and GhIPSS—before reaching their destination.

To enable instant crediting, Zeepay’s banking partner posts funds to GhIPSS on its behalf, expecting Zeepay to settle these positions regularly.

Delays in Zeepay’s liquidity management, compounded by its complex payment cycles, led to the massive liability buildup.

Frustrated, the banking partner severed ties, leaving Zeepay scrambling for a workaround to maintain uninterrupted service.

While Zeepay has managed to keep transactions flowing, reports indicate that at least one major remittance originator has experienced settlement delays, fueling concerns about the fintech’s stability.

The dispute is now in court, with the banking partner demanding immediate repayment.

A Public Policy Failure?

Mr. Simons argues that Zeepay’s case exposes critical weaknesses in Ghana’s payment infrastructure, particularly in GhIPSS’s oversight and technological capabilities.

He states that GhIPSS should have implemented “braking systems”—technological safeguards used in advanced real-time gross settlement (RTGS) and instant payment systems globally—to prevent such liability accumulations.

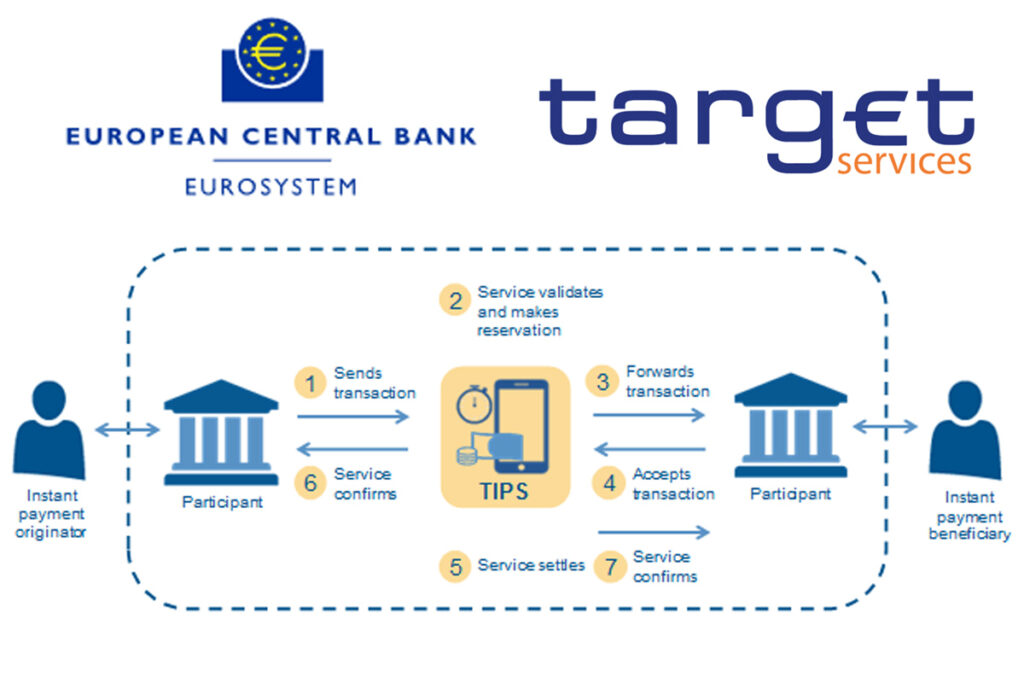

These systems, common in platforms like the EU’s TARGET Instant Payment Settlement (TIPS), monitor and limit exposures in real time, averting disruptions to bank-fintech relationships.

Moreover, questions linger about GhIPSS’s rules on banking partnerships. While Zeepay was required to have a banking partner, some fintechs reportedly bypass this mandate by using e-value collateral, raising concerns about inconsistent enforcement.

Mr Simons questions this inconsistency:

“Why does it appear that some fintechs are told they cannot bypass the requirement, whilst others are allowed to utilise e-value collateral without the banking partner requirement?”

The Bank of Ghana’s National Payments System Strategic Plan, which expired in 2024, called for adopting the EU TARGET interlinking approach to enhance cross-border payment efficiency and manage currency risks—a critical issue for fintechs handling remittances.

Yet GhIPSS has been slow to implement these reforms, leaving firms like Zeepay vulnerable to liquidity and currency exchange challenges.

The Path Forward

Currently, Zeepay and its banking partner are in a legal standoff.

Mr. Simons states that GhIPSS must modernize its platform and clarify its rules. A failure to do so risks stifling innovation and eroding trust in a sector that has become a cornerstone of Ghana’s economy.

As the court case unfolds, policymakers face a stark choice: act decisively to strengthen the payment system or risk stalling the digital finance revolution that has transformed lives across the nation.