An annual Credit Reporting Activity Report for 2024, released this month by the Bank of Ghana (BoG), highlights a staggering 114.6 percent surge in credit inquiries by financial institutions, reflecting heightened reliance on credit data amid an economic rebound.

Credit inquiries — searches conducted by banks and other lenders to assess borrower risk — totaled 29.5 million in 2024, up from 13.7 million the previous year.

This spike, driven largely by the proliferation of digital loans, underscores how credit bureaus are becoming indispensable tools for managing risk in a country where private sector credit expanded by 24.06 percent year-over-year.

“These increases demonstrate the level of acceptance of credit reports in the credit management processes among all types of institutions,” the report states, attributing the growth to improved transparency and regulatory reforms.

Rising Non-Performing Loans and Integration of Credit Bureaus

Yet, the boom comes against a backdrop of rising nonperforming loans (NPLs), which climbed to 21.79 percent by year’s end, from 20.58 percent in 2023.

The Bank of Ghana views the credit reporting system (CRS) as a key mechanism to curb this trend, by reducing “adverse selection” — the tendency to lend to high-risk borrowers without adequate information.

Efforts to bolster the system include extending the deadline for credit bureaus to meet new capital requirements, licensing a third bureau, and introducing credit scoring for the first time.

The capital deadline extension, from January to June 2025, allows bureaus to raise their minimum paid-up capital to 6 million Ghanaian cedis (about $380,000) without operational disruptions.

This reform, initiated in 2023, aims to align Ghana with international standards, ensuring bureaus can invest in secure technologies and maintain data accuracy.

A milestone in 2024 was the licensing of MyCredit Score Limited in October, joining XDS Data Ghana Limited and Dun & Bradstreet Credit Bureau Ghana Limited.

The new entrant began data collection by December and rolled out credit scoring products, enabling lenders to assign numerical scores to borrowers based on repayment history.

Dun & Bradstreet followed suit, marking a shift toward more sophisticated risk assessment.

“This decision is grounded in the Bank of Ghana’s commitment to promote responsible lending,” the report notes, predicting lower default rates and greater access for underserved groups.

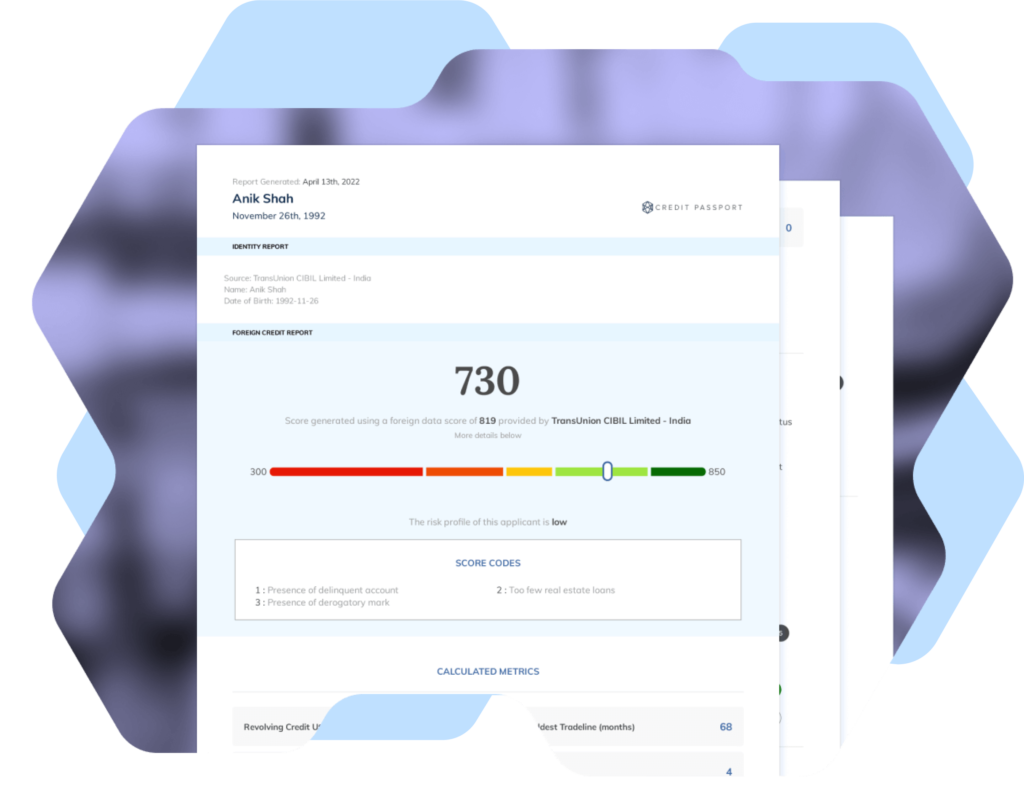

Another innovation: cross-border credit sharing. The central bank approved a partnership between XDS Data and Nova Credit Inc., a U.S.-based firm, to help Ghanaians abroad overcome “credit invisibility” — the lack of recognizable credit history in new countries.

This could ease access to services like bank accounts and rentals for expatriates in the United States, Canada, Britain, and Australia.

Increase in Compliance

Data quality and compliance improved markedly. Monthly loan record submissions averaged 61.3 million, a 190 percent jump from 2023, fueled by digital loans.

Rural and community banks boosted compliance, with an average of 84 achieving full adherence, up from 64.

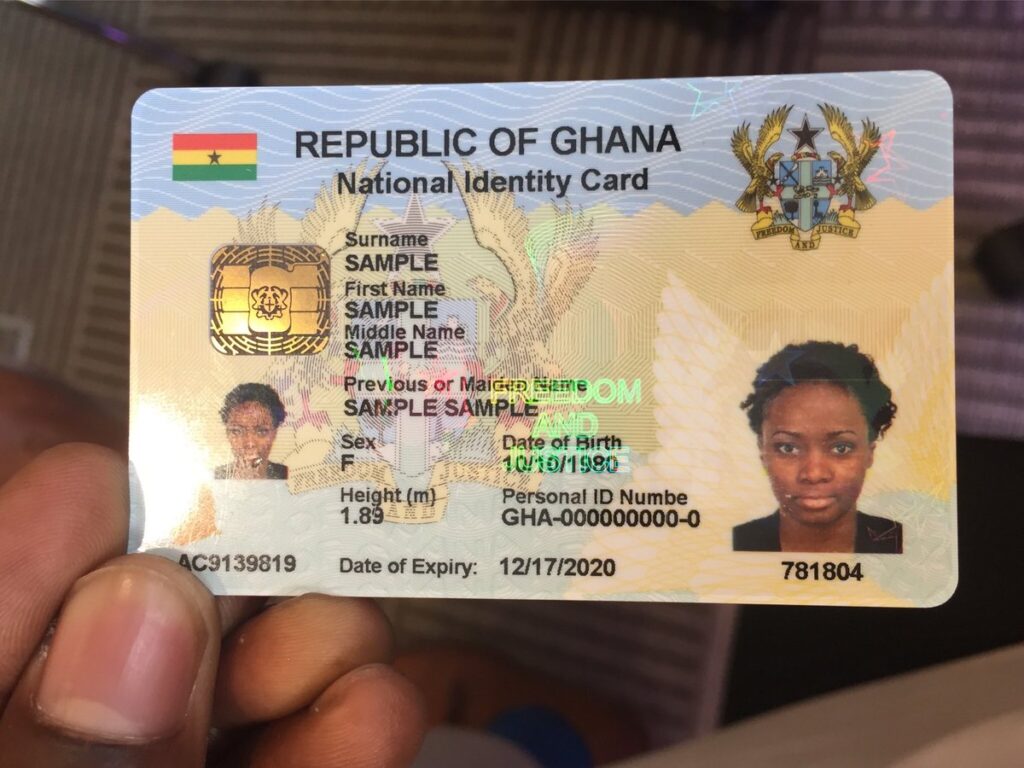

Enforcement of Ghana Card information in records reduced errors in data merging.

Positive trends extended to “dud cheques” — bounced checks — which fell 15.19 percent to 45,136 from 53,522. The decline, linked to public sensitization campaigns, signals growing discipline among borrowers.

Corporate issuers accounted for most (14,454), though down sharply from the prior year.

Rise in Bank Inquiries

Self-inquiries, where individuals request their own credit reports (free once annually), dropped 33 percent to 1,372, possibly indicating low awareness.

Complaints rose slightly by 1.32 percent to 1,617, attributed to greater public engagement with the system; 53 were escalated to the central bank.

Sector-wise, banks dominated inquiries at 84.93 percent, while microfinance institutions followed at 8.82 percent. Hits — searches yielding borrower data — rose to 76 percent, boosted by digital loan records.

Most inquiries (98.32 percent) were for credit applications, with others for know-your-customer checks and recoveries.

The report’s data tables reveal granular insights: Individual borrowers drove 55.2 percent of inquiries, digital loans 44.4 percent, and corporates just 0.4 percent — a drop amid high interest rates and currency depreciation.

Looking ahead, the Bank of Ghana pledges continued oversight, aiming for real-time reporting and sustained compliance.

“These efforts are essential to fostering a more transparent, inclusive, and resilient credit environment,” the report concludes, aligning with broader goals of financial inclusion and economic growth.

This article was edited with AI and reviewed by human editors