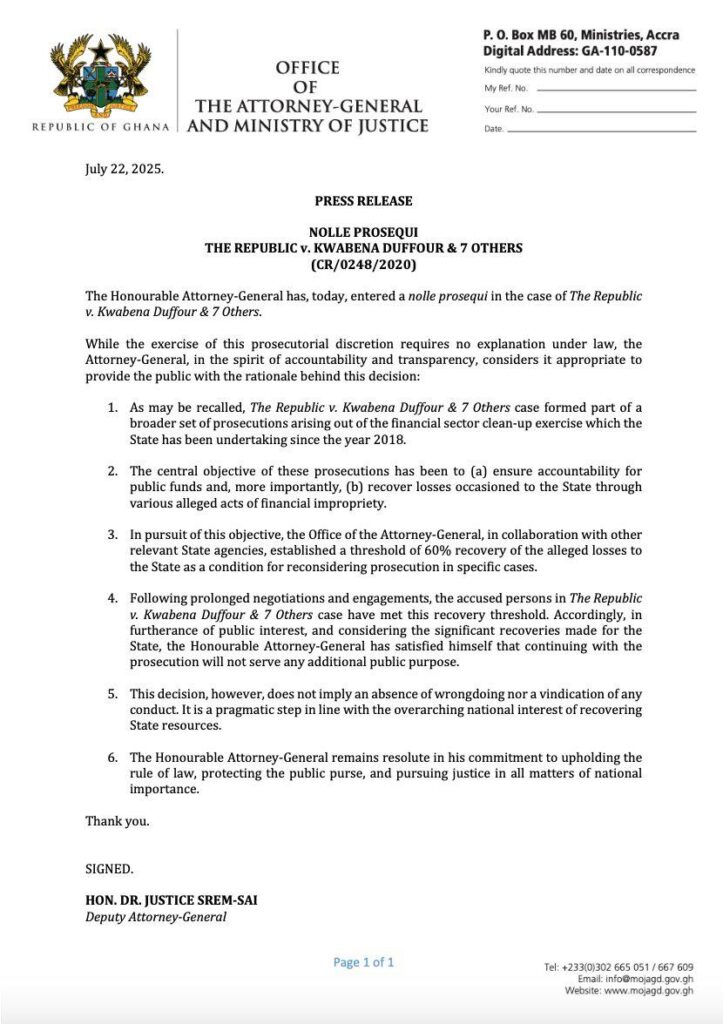

On Tuesday, 22nd July, 2025, Ghana’s Office of the Attorney-General issued a press release announcing a nolle prosequi — a formal decision to abandon criminal prosecution — in one of Ghana’s most high-profile financial crime cases: The Republic v. Kwabena Duffuor & 7 Others.

The case had been central to the State’s reckoning with the banking crisis that unfolded in the years leading up to 2017’s financial sector “clean-up.”

Why the sudden halt?

In its press release, the Deputy Attorney-General Justice Srem-Sai stated the accused, after “prolonged negotiations”, had agreed to refund 60% of the money allegedly lost to the State.

“This decision does not imply an absence of wrongdoing,” the statement read.

No details were given on the timeline for the refund or how much would be refunded.

2017 Banking Clean Up

The decision to halt this prosecution comes nearly eight years after Ghana’s banking system went through one of its most turbulent periods.

In 2017, the Bank of Ghana began a sweeping reform process aimed at stabilizing a sector plagued by insolvency, poor corporate governance, and risky lending practices.

By 2019, the central bank had revoked the licenses of nine commercial banks and over 400 financial institutions, including microfinance and savings and loans companies.

Among the casualties were Capital Bank and uniBank — both tied to figures like Dr. Kwabena Duffuor, a former Finance Minister and owner of uniBank.

According to regulators, some banks had engaged in insider lending, false reporting, and diverted depositors’ funds for personal and political gain.

To protect depositors and “purify” the system, the government injected over GHS 21 billion into the sector.

A Messy Clean Up

From the outset, Ghana’s banking clean-up has been as controversial as it has been consequential.

Key decisions — from the selection of banks for resolution, to the valuation of their assets, to the prosecution strategy — were often shrouded in silence.

Some accused the government of weaponizing regulatory power to target political opponents, while others argued that delays in court cases weakened the credibility of the clean-up.

This week’s announcement may reinforce those concerns.

Eroding The Impact of ORAL?

The Operation Recover All Loot (ORAL) initiative, which was launched in 2025 by the current government administration, was designed to pursue and retrieve state assets lost through fraud, corruption, and financial mismanagement.

It was a big part of President Mahama’s election campaign to root out corruption and prosecute offenders.

With the announcement of the non-prosecution of officials in the banking clean-up, will this negatively affect the initiative?

So far, the ORAL can point to recent wins, including the current case against the former Director General of National Signals Bureau Adu-Boahene boss and the Interpol alert for the former Minister of Finance.

But with the dropping of this case, it follows a trend whereby officials face no jail time.