In 2024, Maame Richardson opened her first Boba Tea spot called Café de Boba in the Dzowrulu area of Accra.

An entrepreneur at heart, Ms Richardson kicked off her journey of owning a shop after trying Boba while on vacation in Dubai.

Thanks to a friend who brought the infamous Boba pearls from China, she started making her own drinks at home and experimenting with new flavors.

After encouragement from friends, she decided to take the leap and start her own business, and has been enjoying relative success.

Boba Tea, which has been trending globally, has caught on in Ghana. The phenomenon has evolved from being virtually unknown a decade ago to a full-blown trend among Ghanaian Gen Z and millennials.

There are now dozens of shops in Accra and emerging locations in Kumasi that sell the drink to consumers.

The Tea from Taiwan

Boba tea became prominent in the 1980s. The country’s economic boom led to a shift in food culture, allowing people to explore new, leisure-focused beverages.

The initial innovation came in the 1940s, when a former bartender named Chang Fan Shu began shaking tea with ice and other ingredients in a cocktail shaker.

Later in 1988, a product development manager called Lin Hsiu Huix claimed she spontaneously poured sweetened tapioca balls into her iced Assam milk tea during a staff meeting. The combination proved to be a hit, and it quickly became their top-selling product.

Boba tea’s defining ingredient—the chewy tapioca pearls—was introduced in the mid-to-late 1980s. (This is something that is currently being debated)

Growing Popularity in Ghana

Fika Teahouse, which was opened by Dzifa Agbeti, was one of the first popular boba tea spots in Ghana. In 2020, the drink became more popularised thanks to increased use of social media platforms like TikTok and Instagram.

Currently, there are more than a dozen boba tea shops open across Accra and Kumasi with well-known brands including Fika Teahouse, Boba Fie, and Daddy Boba.

Drinkers of Boba tea are dominated by the youth and millennials. In an informal poll conducted by The Labari Journal, the majority of boba tea drinkers are between 18-24 years and 25-34 years.

Depending on the location, a cup of Boba tea can average between GHC 30 – 50, with higher prices for more variety and flavors.

Most spots tend to be situated in areas such as East Legon, Airport, and Labone, with new spots opening up more frequently.

International Appeal

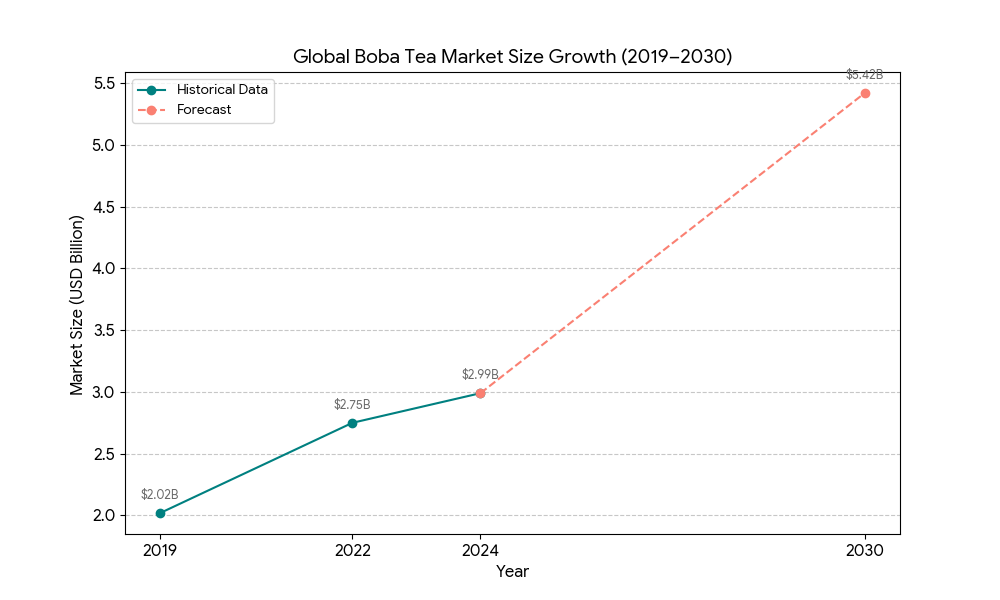

The global boba (or bubble) tea market is experiencing robust and sustained growth, transitioning from a niche Asian beverage to a globally embraced, customizable treat.

Its growth is primarily fueled by strong demand from younger demographics, social media trends, and menu diversification.

The market is expected to nearly double between 2024 and 2030, driven by its global trend status, and is expected to reach a market value of over $5.4 billion by 2030.

Economic and Health Impacts

Currently, most Boba ingredients are imported. Shop owners regularly import blueberries, strawberries, and blackberries from locations like China to infuse in their Boba drinks.

Ghana’s massive cassava production (~20M+ tonnes/year) has the potential to fuel local tapioca pearl manufacturing.

Some challenges for most current Boba tea shop owners include the high import costs.

For instance, shipping 500 kg of boba pearls priced at $1.40/kg could total almost $700. Factoring in shipping (eg. $500 for Sea Freight), a store owner could be looking at almost $1200 (excluding taxes).

In local currency, store owners can expect to pay about GHC 13,200 to acquire ingredients to produce their drinks.

There are also some health implications with frequent consumption of Boba tea.

A single cup can contain between 20 and 50 grams of sugar, sometimes even more. This can easily exceed the recommended daily limit for added sugars.

Some shops like Cafe de Boba give customers the option of leaving out the sugar entirely when ordering their drinks.

The Future of Boba in Ghana

As Boba gets more popular, there is a reasonable expectation of more chains and shops springing up and expanding beyond the cities of Accra and Kumasi.

Innovation and localization will be paramount as competition grows.

Successful brands will be those that skillfully navigate the balance between offering authentic, traditional Taiwanese flavors and embracing local palates and dietary concerns.

Ultimately, the sweet, chewy pearls of boba are set to become a permanent, diverse, and delightfully localized fixture in Ghana’s dynamic beverage landscape.