There is nothing more frustrating than not having cellular service when you really need it.

Although telecom providers invest millions into building cell towers to try and connect users to their services, sometimes there are gaps called “dead zones“, where voice and data service are unavailable.

But thanks to satellite technology, dead zones may be a thing of the past, especially in the African region, if SpaceX is successful in its latest venture.

Starlink, Elon Musk’s satellite internet service, made headlines when it first launched in 2018. The service uses satellites to beam data to users equipped with Starlink kits on the ground.

According to the company, it had an estimated 4 million subscribers as of September 2024.

Now the company has a new trick up its sleeve, which may spook some local telecom providers. That new trick is Direct to Cell service.

About The Service

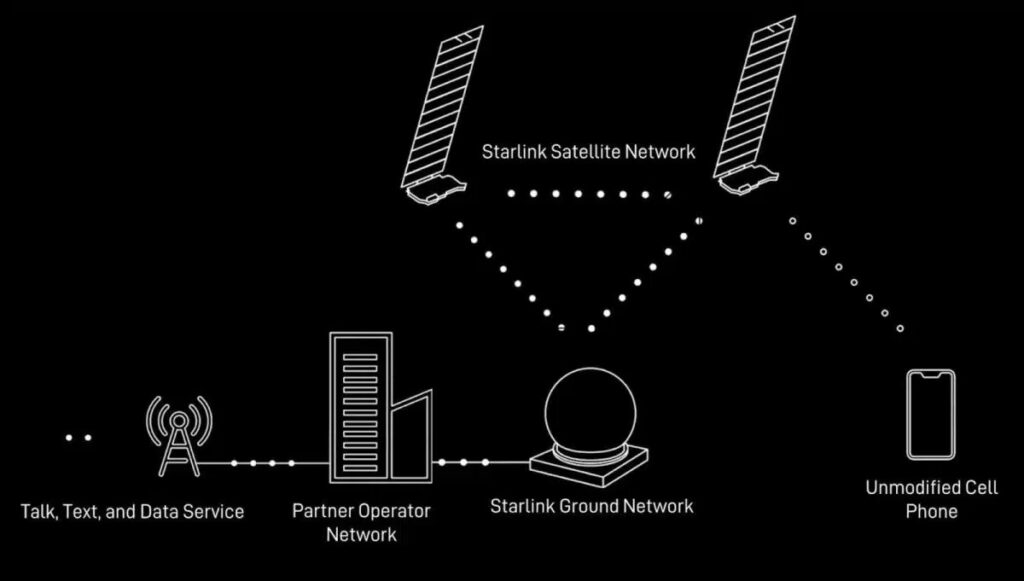

Starlink’s “Direct to Cell” service allows unmodified LTE smartphones to connect directly to satellites without additional hardware. It was first announced in August 2022, with SpaceX and the US telecom company T-Mobile partnering up to provide universal cellular connectivity.

SMS texting became publicly available in the U.S. and New Zealand in July 2025, to international networks including T-Mobile, AT&T, Verizon, and One NZ.

The service now offers talk and data services on five continents.

On its website, Starlink claims that its Direct to Cell has become the largest 4G coverage provider on planet Earth, connecting over six million users and counting.

Securing New Spectrum

On September 8th, SpaceX announced its $17 billion acquisition of wireless spectrum assets from EchoStar, a US telecommunications company specializing in satellite communication. The move secured prime airwaves for direct-to-cell services globally.

“It’s a leap toward ubiquitous connectivity,” Elon Musk posted on X shortly after the deal closed.

The spectrum — encompassing AWS-4 and H-block licenses — will allow Starlink satellites to interface directly with standard phones, potentially serving billions without the need for specialized equipment.

Service plans for businesses and governments are already rolling out in select markets, with consumer access expected in 2026.

Conflict with African Players

For Africa’s 1.4 billion people, where only about 45 percent have reliable internet access, these developments could be transformative.

The recent news could have advantages for consumers on the African continent.

According to data in 2024, 38% of the population had internet access, significantly lower than the global average of 68%.

With Starlink’s satellites, orbiting in low Earth orbit, the company offers direct access to internet services, offering speeds up to 100 Mbps.

Nigeria’s communications ministry fast-tracked Starlink’s license in 2023, crediting it with spurring a 20 percent uptick in rural data subscriptions.

However, Starlink has been causing tensions, especially among local telecom incumbents.

Companies like MTN Group, Vodacom, and smaller regional players have invested billions in ground-based networks and face more regulatory scrutiny compared to Starlink.

In 2024, Kenya’s Safaricom and South Africa’s Vodacom wrote to the Communications Authority of Kenya’s director-general to express concerns about the granting of independent licenses to satellite internet providers like Starlink.

Friend or Foe for Telcos?

In the US, Starlink’s Direct To Cell monthly subscriptions range from $10 to $15 for standalone service or $20 per month when tied to major carriers like T-Mobile.

The standalone fee for the average African could be out of their budget. It’s more likely that Starlink could actually be a partner rather than a competitor for local telcos.

Similar to deals done in the US, SpaceX could sign deals with MTN and Vodacom to offer services where connectivity is an issue.

Earlier this year, Airtel Africa signed a deal with Starlink to offer internet services across jurisdictions in which the company operates.

If SpaceX eventually offers Direct to Cell services, Airtel could be the first major African player to offer it to customers for an added fee.

The Way Forward

As Starlink’s constellation swells to over 6,000 satellites, its African footprint is poised to cover 95 percent of the population by 2027, per company projections.

Although voice and data services are still the primary domain of telecom providers, an entity with the ability to beam data services directly from space could be a new territory.

However, partnerships might be the best outcome to provide more coverage. Whether consumers would completely switch to a standalone Starlink mobile data service remains to be seen.

In March 2025, telecom operator MTN South Africa partnered with low Earth orbit (LEO) satellite provider Lynk Global for a direct satellite-to-mobile device phone call.

With this continued trend, it looks like space connectivity might be the next battleground for innovation.