The article was republished from CediTalk

The Ghana cedi has been on an absolute tear this year, leading many people to speculate about the cause of such a strong appreciation.

Official rates from the Bank of Ghana show that the currency ended 2024 at the rate of 14.7074 cedis to the US dollar.

At the time of writing, it is currently trading at 13.3067, a remarkable 10.5% gain.

The strong Cedi has resulted in mixed feelings.

Many people are happy to see the cedi recover so strongly because it means the prices of imported products (particularly fuel) are going to fall, bringing much-needed relief to consumers.

On the other hand, investors have loaded up on dollars over the years due to a lack of confidence in the Ghana cedi. They are now seeing unrealized losses on their portfolio and are eager to find out whether they should sell all their dollars before they see further losses.

In this post, I will explain some of the factors behind the cedi’s strength.

Historical bull market for gold

One advantage of having been an analyst of Ghana’s economy and financial markets for so long is that you see cycles. Back in 2015, I wrote about how weak commodity prices were hurting the economy.

And in 2025, strong gold prices are contributing to an economic recovery. Just take a look at the chart below.

I think the chart is self-explanatory. Gold prices have risen significantly from about $2,000/ounce in early 2024 to about $3,400/ounce in May 2025.

The surge in gold prices has partly been driven by falling confidence in a US-led global order as central banks around the world accumulate gold.

Ghana is the sixth largest gold producer in the world, and the bull run in gold could not have come at a better time for the nation’s troubled economy.

In 2024, Gold exports were $11.6 billion compared to only $7.6 billion in 2023. This resulted in a healthy $4.98 billion trade surplus, easing pressure on Ghana’s scarce forex reserves.

Central bank and GOLDBOD gold purchases

First, the Bank of Ghana (BoG) and then the Gold Board (GOLDBOD) have engaged in the purchasing of gold from small-scale miners, with the latter institution now the sole mandated entity to make such purchases and exports.

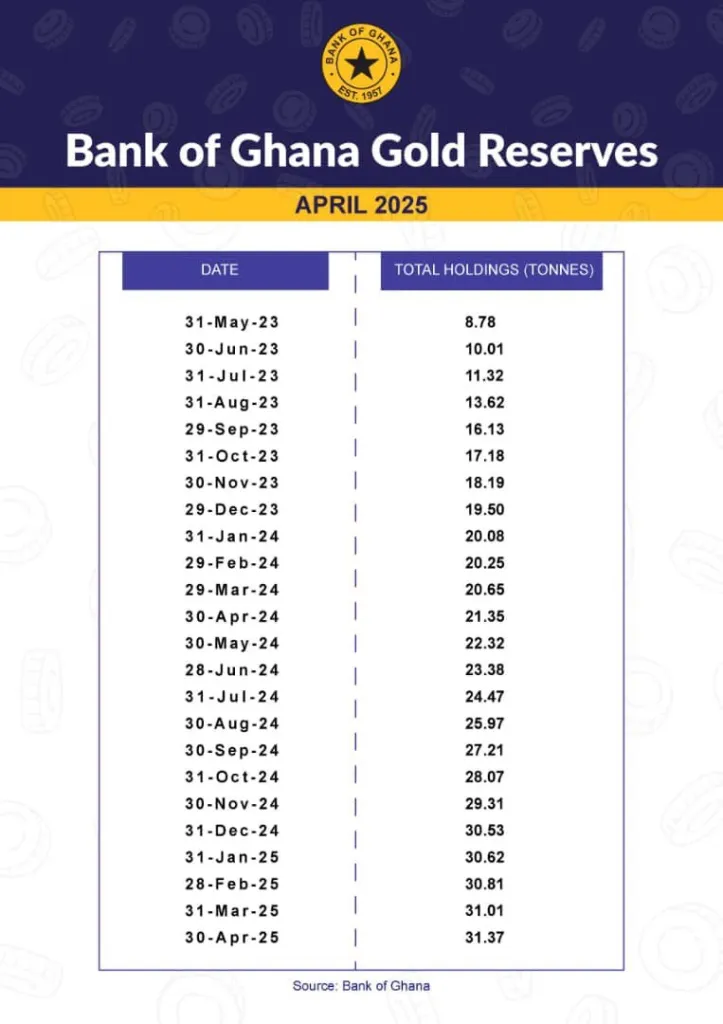

This has resulted in the BoG’s gold reserves rising from just under 9 tonnes in May 2023 to just over 31 tonnes at the end of April 2025. This is shown below.

One should note though that it is not enough to accumulate gold reserves; the value of the reserves should be growing. And so should gold be accumulated, but if the price of gold takes a deep dive, the Bank of Ghana will take losses on its gold purchase programme.

However, the strong gold performance helped the BoG’s gross international reserves jump from $6.2 billion in February 2024 to $9.4 billion in February 2025. This leads to my next point.

President Mahama and the NDC’s decisive victory in the December 7 polls, as well as the swift concession of Dr Bawumia, have assured investors that the president will have a strong mandate to carry out the fiscal reforms he proposed.

A healthy supply of forex on the market

In November 2024, I wrote about the aggressive intervention of the central bank in the forex market that took the dollar from about 16.4 cedis to end the year at about 14.7.

It was my belief that this policy would end in 2025.

However, despite the scale of intervention reducing from that time, the BoG has nevertheless made dollars available to meet the demand in the market.

In April, it started providing forex on the spot market rather than the 7-day forward auctions that it mostly relied on to supply the market.

This instant availability of forex has calmed business concerns that forex would not be available when they demand it.

Fiscal reforms and economic optimism

President Mahama and the NDC’s decisive victory in the December 7 polls, as well as the swift concession of Dr Bawumia, have assured investors that the president will have a strong mandate to carry out the fiscal reforms he proposed.

The BoG’s business confidence index was at 99.7 in February 2025, the highest recorded since way back in December 2020. The finance minister’s budget preached fiscal discipline as well as reforms to prevent the unsustainable accumulation of public sector debt.

But more than just talk, Finance Minister Dr Ato Forson has halted payments on arrears of about GHS 65 billion pending an audit.

This has provided the minister with room to turn away bids at the treasury auction and drive t-bill rates down from about 28% to about 15%.

The IMF has also reached a staff-level agreement with the ministry on the 4th review of the 3-year program and $370 million is expected to be on the way after IMF board approval.

Hawkish BoG Monetary Policy

The BoG surprised many analysts by increasing the policy rate to 28% from 27% in March 2025.

This aggressive stance towards tackling inflation also reduces liquidity in the system and helps to strengthen the cedi.

Weak Dollar

I know this is an unsatisfactory explanation for many because the cedi is just flat out strong against any currency.

However, we should note that the strength of the cedi has coincided with the dollar index (a measure of the dollar’s strength against a basket of currencies) falling from about 108 at the start of 2025 to about 99 at the time of writing.

The Outlook

Uncertainty is the only thing that is certain in the market. Nevertheless, we can make some educated guesses on the direction of the currency based on the following.

- Eurobond payments. About US$3.6 billion in eurobond payments is expected to be made between now and 2028. These will weigh heavily on the dollar reserves, assuming the government is unable to return to the capital markets to refinance them.

- Domestic bond payments. The government could face a bill of about GHS 200 billion in paying maturing bonds, cocoa bills, and domestic dollar bonds that were all restructured in the DDEP. This could mean more cedi liquidity and thus less motivation to keep cedis unless interest rates rise significantly.

These two factors, as well as the possible end of the gold rally, pose the greatest threats to the currency going forward.

The finance minister has announced that Ghana’s Debt Sustainability Plan will be revealed in the next budget review in July this year.

I will be looking out for the government’s plan on how to settle these payments and write about what it could mean for the currency.