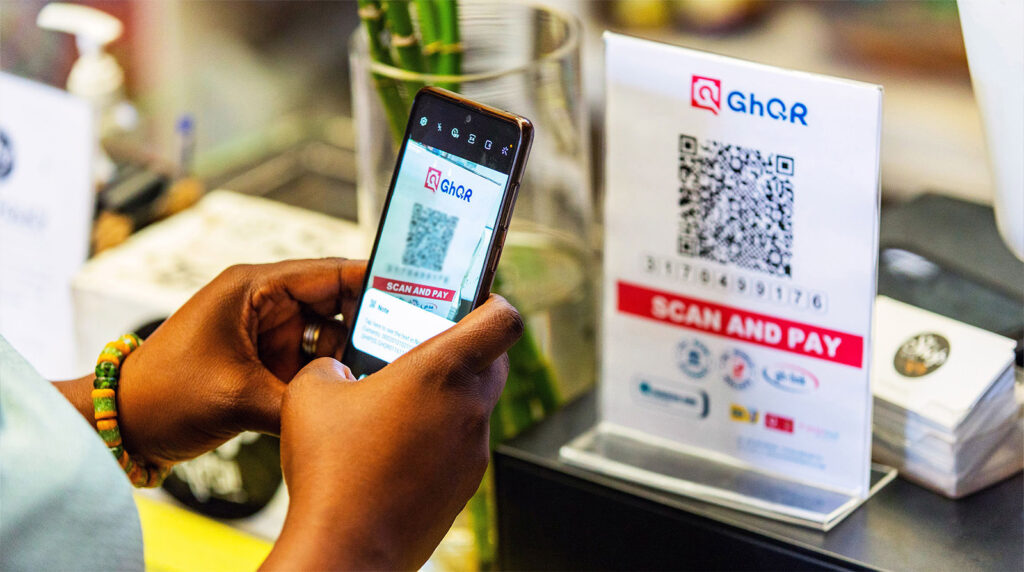

In 2020, Ghana officially launched its universal QR code payment system, known as GhQR.

With GhQR, users could scan displayed QR codes with their smartphones and pay, or dial displayed USSD codes to make a payment.

When it was launched, it was the first of its kind in the African region.

The former head of Ghana Interbank Payment and Settlement Systems (GhIPSS), Archie Hesse, encouraged Ghanaian users to take advantage of the payment channel at the launch.

“The more we use GhQR to make payments, the more merchants will be encouraged to deplore it at their outlets, but if we don’t use it, there will be less motivation for them to do so,” he said.

But five years on, as of mid-2025, the system appears to be facing challenges to wide adoption, mostly due to

About The Platform

Developed by GhIPSS in partnership with the Bank of Ghana (BoG), the GhQR platform allowed consumers to scan a merchant’s QR code using their mobile phones to make instant payments from various funding sources, including bank accounts and mobile wallets.

This interoperability is key to its appeal, enabling seamless transactions without needing point-of-sale terminals, which are often costly for small businesses.

The system integrates with GhanaPay, a mobile wallet launched by the central bank to serve banks, savings and loans companies, and rural community institutions.

Adoption was slow at first but picked up after 2021.

It was reported that 42,000 merchants had signed up to use the QR platform in 2021.

In public spaces, including supermarkets and shops, merchants display a large QR code at their pay counters which consumers can scan to make payment.

In 2024, the BoG and GHIPSS did not share numbers on QR Payment transaction data or volume in their reports.

The Labari Journal has been asking users about the usage of QR payments. Many had heard about it and had tried using it without success.

“It just doesn’t work,” one user noted.

Another user noted that mobile money seemed like a better option compared to QR payments.

“Momo and banking app transfers are more convenient and easier to understand and troubleshoot,” they noted.”

Mobile Money is King

While QR payment adoption is still slowly on the uptick, mobile money is by far and away the most used option in Ghana.

The BoG reported that the value of mobile money transactions exceeded GHC 3 trillion in 2024.

The latest report showed that the value of transactions across mobile money networks (interoperability) had exceeded more GHC 25 billion by June 2025.

The report also shows that mobile money saw a total value of transactions reaching a high of GHC 365 billion in April 2025.

With the continued success of mobile money, can Ghanaians factor in QR payments? Compared to other markets, QR still has a long way to go

QR Payments In Other Markets

Ghana’s progress in QR payments is modest compared to juggernauts in Asia and Latin America.

India’s Unified Payments Interface (UPI), for instance, has exploded in popularity, processing 19.47 billion transactions worth approximately $302 billion in July 2025 alone.

UPI’s success stems from the fact that it’s backed by 684 live banks and government incentives like zero fees for small transactions.

In China, platforms like Alipay and WeChat Pay dominate with about 90% market share, serving 1.4 billion people through QR-based mobile wallets.

What makes these countries excel in adoption? China’s early investment in infrastructure and regulatory support is a major factor.

Ghana is trying to emulate similar success but on a smaller scale.

In Latin America, Brazil’s Pix system offers a compelling parallel. Launched in 2020 like GhQR, Pix enables instant transfers via QR codes or keys, achieving over 70% adoption among adults by 2025.

It’s mandatory inclusion for all banks mirrors Ghana’s interoperability push, but Pix benefits from higher smartphone ownership and aggressive marketing, resulting in billions of monthly transactions.

Looking Forward

Emerging markets like Ghana stand to gain the most, as digital payments enhance inclusion and economic efficiency.

Mobile money growth has been exponential, but QR payments are playing catch-up. The platform could grow faster if more awareness and promotion from the BoG and banks were pushed.

“Awareness is poor,” one user said. “GhIPPs should collaborate with banks to create more awareness to the public.”

As the BoG focuses on virtual assets, which could open up stablecoin usage and other crypto payments, will the GhQR platform be left to the wayside, or will it become more useful?

It remains to be seen.