The Bank of Ghana (BoG) is planning to introduce the Virtual Asset Service Providers (VASP) Act by September 2025, a legislative framework that could have major repercussions for Ghana’s fintech ecosystem.

According to reports, approximately 3 million Ghanaians—17% of the adult population—actively use cryptocurrencies like Bitcoin, Ethereum, and USDT.

It is estimated that $3 billion in crypto transactions were recorded from July 2023 to June 2024.

The BoG’s upcoming bill aims to bring regulatory clarity to a rapidly growing market while balancing innovation with financial stability.

Currently, the regulator is requiring all Virtual Asset Service Providers—encompassing crypto exchanges, wallet providers, custodians, and brokers—to register with the BoG by August 15, 2025.

All registered companies would need to comply with stringent anti-money laundering (AML), Know Your Customer (KYC), and counter-terrorism financing (CFT) regulations.

A Response to a Digital Surge

Ghana’s fintech landscape has been thriving, driven by high mobile money penetration, a tech-savvy youth demographic, and widespread internet access.

Mobile money services, operated by telecom giants like MTN Ghana and Telecel Ghana, dominate the sector, facilitating everything from utility payments to remittances.

The rise of cryptocurrencies, however, has added a new dimension, with Ghanaians increasingly turning to crypto for cross-border payments, savings, and investments.

“As a regulator, and together with other regulators such as the Securities and Exchange Commission (SEC), GRA [Ghana Revenue Authority] and others, we are joining efforts to engage in regulating that activity and to ensure that the benefits accrue to us while minimising the risks” said Dr. Johnson Asiama, Governor of the BoG, at Breakfast Meeting in Accra.

The BoG’s draft guidelines on digital assets, released in August 2024, emphasize consumer protection, cybersecurity, and financial stability, drawing inspiration from the European Union’s Markets in Crypto-Assets (MiCA) regulation and Singapore’s Payment Services Act.

Opportunities for Fintech Growth

Ghana’s fintech space is largely dominated by payment apps, which offer payment services including utility and bill payments and mobile money transfers.

Blockchain and decentralized finance are largely untapped spaces due to regulations hindering crypto features and payments.

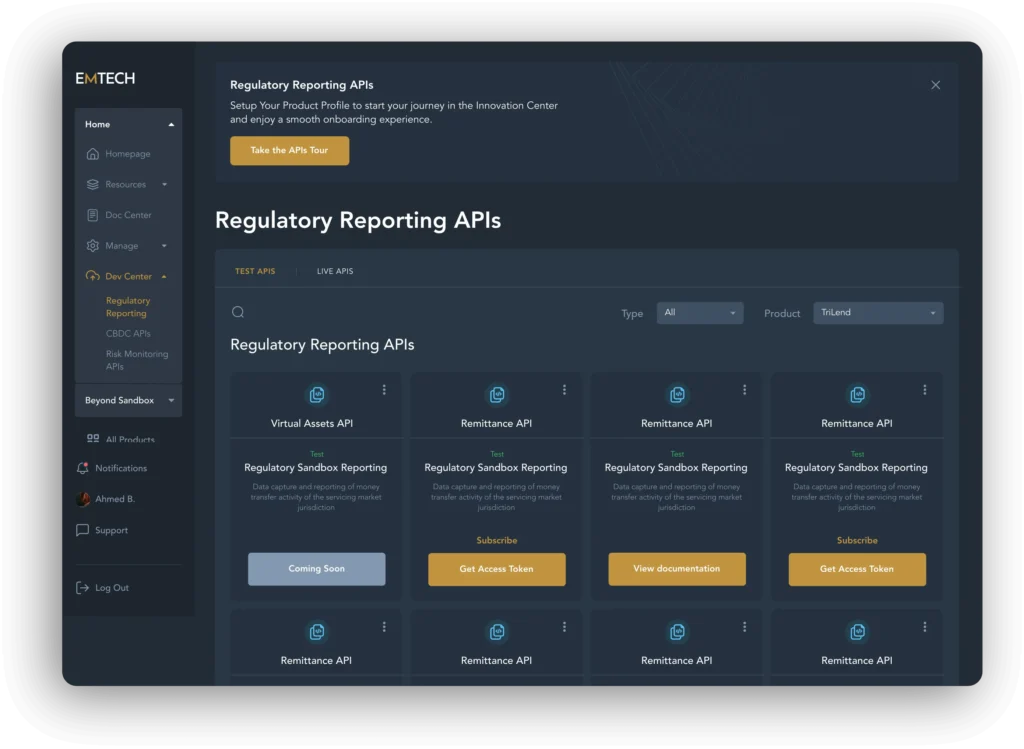

But the BoG’s regulatory sandbox, launched in 2022 with EMTECH, a web3 company, has already fostered some blockchain innovations.

The VASP Act could expand such initiatives, enabling fintech startups to explore tokenized assets, stablecoins, and decentralized finance (DeFi) applications within a controlled environment.

The BoG will collaborate with the Securities and Exchange Commission (SEC) to ensure complementary oversight, with the SEC focusing on digital asset offerings in the capital markets.

This coordinated effort could streamline compliance for fintechs operating across multiple financial domains.

Challenges and Concerns

Despite the optimism, challenges loom.

Smaller VASPs and peer-to-peer (P2P) operators may struggle with the compliance costs associated with licensing, AML/CFT requirements, and capital thresholds.

Although Ghana has a tiered system that licenses startups at different levels, the outcome of the bill could limit early-stage fintechs.

Moreover, while regulation aims to curb risks like money laundering and fraud, the inherent volatility of crypto markets could still impact users and the broader economy if not carefully managed.

Economic and Social Implications

The VASP Act is part of a broader push to modernize Ghana’s financial sector.

By formalizing the crypto market, the BoG aims to integrate digital assets into the mainstream financial system, particularly for remittances.

Ghana has one of the highest remittances in Africa, with a record $6 billion in 2024.

The use of crypto, particularly stablecoins, for cross-border transactions could reduce transaction costs and enhance financial inclusion, especially for Ghana’s unbanked population.

Opening The Door For More Fintech Players

Ghana’s regulatory pivot could make it more attractive to global fintech players.

The BoG’s planned Digital Assets Unit, to be established post-legislation, will be critical in coordinating oversight and fostering innovation.

If executed well, the new bill could unlock new opportunities for digital finance in the country.

It could allow local fintechs to build new features for users, which could leverage cross-border payments and virtual asset services.