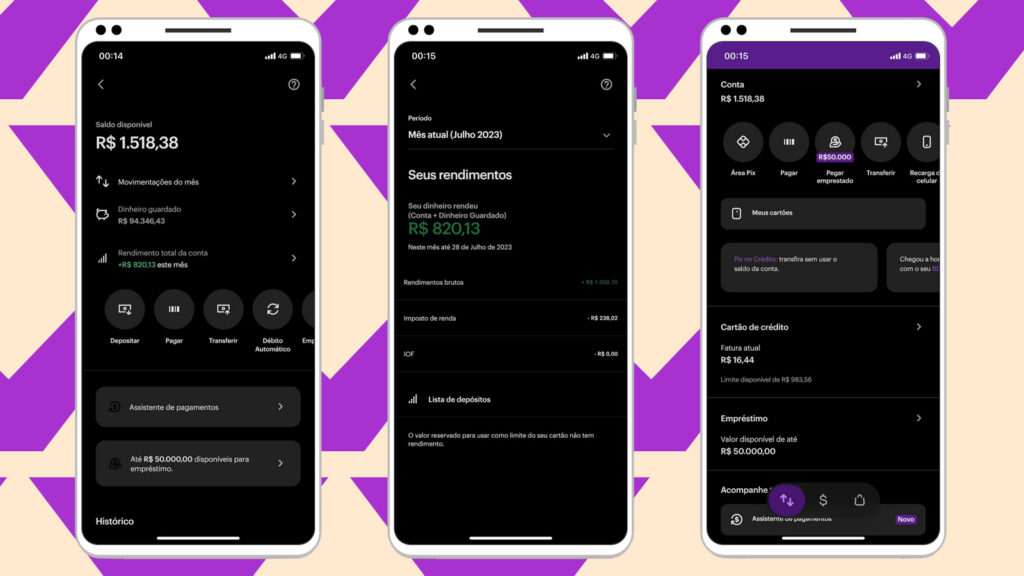

In 2013, Nubank, a fintech company in Brazil, officially launched its digital banking product. The company focused on becoming a customer-centric and technology-driven financial institution for consumers.

Nubank scaled quickly, going into markets like Colombia and Mexico and eventually going public in 2021.

Digital banks or “neobanks” are steadily growing worldwide. Neobanks digitize traditional banking activities and services that were previously only available in physical branches.

Their services include money deposits, withdrawals, transfers, loan applications, and account management—all accessible online through websites, mobile apps, or other digital platforms.

In the African fintech space, a few digital banks are coming up on the horizon. In Ghana, Affinity Africa is adding itself to the list of new players.

Since 2019, Affinity has been slowly growing into a dynamic digital bank, quietly challenging some norms in the industry.

The Labari Journal spoke with two representatives, Michael Annor (Head of Product) and Rakan Mahamudu (Analyst), at Affinity’s head office in Accra.

We delved into how Affinity Africa was built and the company’s plans for growth.

From Microfinance Roots to Digital Banking

Affinity’s story began before its official 2022 launch. The company started operations under a microfinance license, which the team saw as a pragmatic way to enter the market.

“We didn’t want to just do payments,” says Michael Annor. “We wanted to challenge ourselves to build something that could evolve into long-term financial infrastructure for people and small businesses.”

But their goal was always bigger: to become a deposit-taking, tech-enabled bank that meets customers where they are — whether that’s through a mobile app, field agents, or USSD.

The transition hasn’t been smooth sailing.

Regulatory hurdles meant waiting years for licensing approvals, while simultaneously building out technology, testing products, and serving customers through stopgap solutions.

According to the team, getting approval for its license took almost three years.

“We learned to be patient,” Michael shared. “We were running a microfinance business by day and building Affinity by night.”

Rethinking How Consumers Access Money

In 2023, the Bank of Ghana (BOG) released data showing that the majority of local banks in the country offered loan rates above 30%.

For Small Business Enterprises (SMEs) and informal businesses, high lending rates can be a turnoff. Getting access to loans without a proper credit rating for those same users poses another challenge.

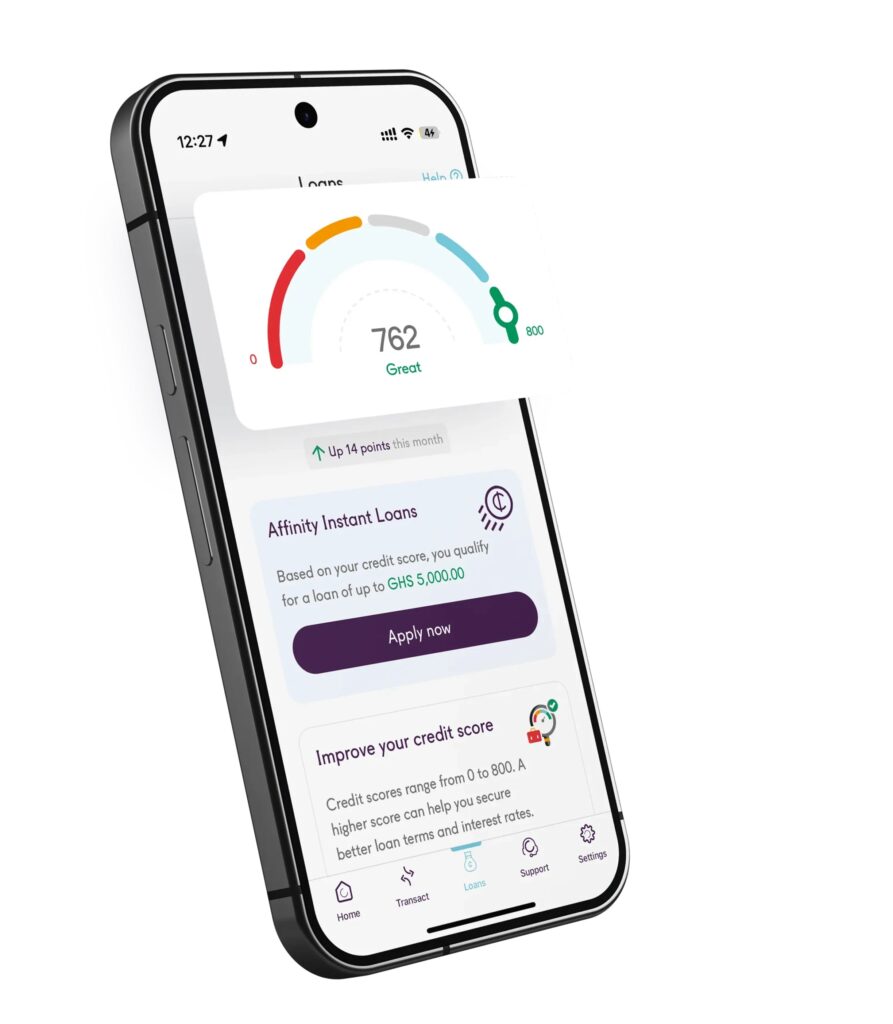

Affinity is trying to focus on helping its users by providing its own loan and credit feature.

The company’s approach to credit and lending is particularly notable.

Instead of using third-party data sources like phone metadata or social media (a method done by other African lenders), Affinity developed its own credit scoring engine based on user behavior on its platform.

Affinity’s lending model focuses on fairness: interest accrues on a reducing balance (not a fixed lump sum), and users can repay early without penalty.

This, they believe, builds trust and keeps customers coming back.

Building a Trustworthy Bank People Want to Use

In 2024, Affinity Africa raised $8 million from investors to expand its services across Ghana and other markets.

The company currently has over 60,000 users signed up, with 45,000 being active.

Their user base includes salaried workers and informal traders using the platform to manage their cash flow.

The platform has features including savings, payments, and loans. The company has more impactful products coming in the long term, including remittances, mortgages, and long-term business capital.

As they continue to build and scale, the team admits that building trust has been one of their biggest challenges.

“We launched in a market where people didn’t even know how MTN MoMo worked,” said Rakan, referencing the challenge of onboarding users to unfamiliar digital systems.

To combat this, Affinity invested in field agents, a customer contact center, and robust support systems to gain the trust of its customers.

With internal tools like their credit engine, the team ensures data remains private and decisions remain transparent.

Leveraging existing credit scoring tools from third parties was an option, but Affinity decided to go its own route.

“We could have used third-party scoring tools,” Michael says. “But the cost was too high, and it generated long term interdependencies. So we built our own.

The result is a system where users begin building their score from day one.

Users who meet internal benchmarks after 30 days on the platform can access small loans (GHC 100), with higher amounts unlocked (GHC 5,000) as they build a responsible track record.

“We want to grow Affinity into a household name — a brand that feels like it was built for the market, not imported into it.”

On Fundraising, VCs, and Staying the Course

Although funding announcements are seen as great milestones and achievements for growing startup firms, the Affinity team was candid about the challenges of raising capital in Africa’s fintech space.

“Venture Capitalists (VCs) often come with expectations that don’t fit our context,” Michael noted.

They’ve learned to say “no” to some offers, focusing instead on building a sustainable business with a clear North Star: serve customers well, and everything else will follow.

The company has about 100 employees working on different teams, including products, customer service, and marketing.

When asked about the prospects of acquisition by a bigger company compared to steadily building towards a target like an Initial Public Offering (IPO), the team said they would prefer the latter.

“We want to grow Affinity into a household name — a brand that feels like it was built for the market, not imported into it,” Michael said.

“Being acquired is fine, but it can come with strategic drift. We want to grow into a profitable, sustainable brand—whether or not we ever get a big investment headline.”

Affinity Africa takes a lot of inspiration from Nubank. Although they have a long way to go to reach the heights of the South American firm, they’re taking their time to build a sustainable digital banking platform for their users.

The team is currently working on new features, including a personal dashboard for both web and mobile.

Other features like remittances, virtual cards, and physical cards are on their long-term road map.

But their major focus for this year is Business Banking. They aim to pilot services for micro and small businesses, including digital onboarding and access to loans.

“We should start piloting in Q2, so maybe by Q3, really understand the issues, what we’ve done right, and what we’ve done wrong,” Michael stated.

International expansion is also on the radar, though it’s something that’s being cautiously approached.

“We don’t want to spread ourselves thin. But we believe the Affinity model can work in other African countries where financial inclusion is still a real challenge.”